Rapid, disruptive technological change is a feature of modern life as we know it, and the sharp growth of artificial intelligence (AI) has sparked concern that many jobs are at risk of automation.

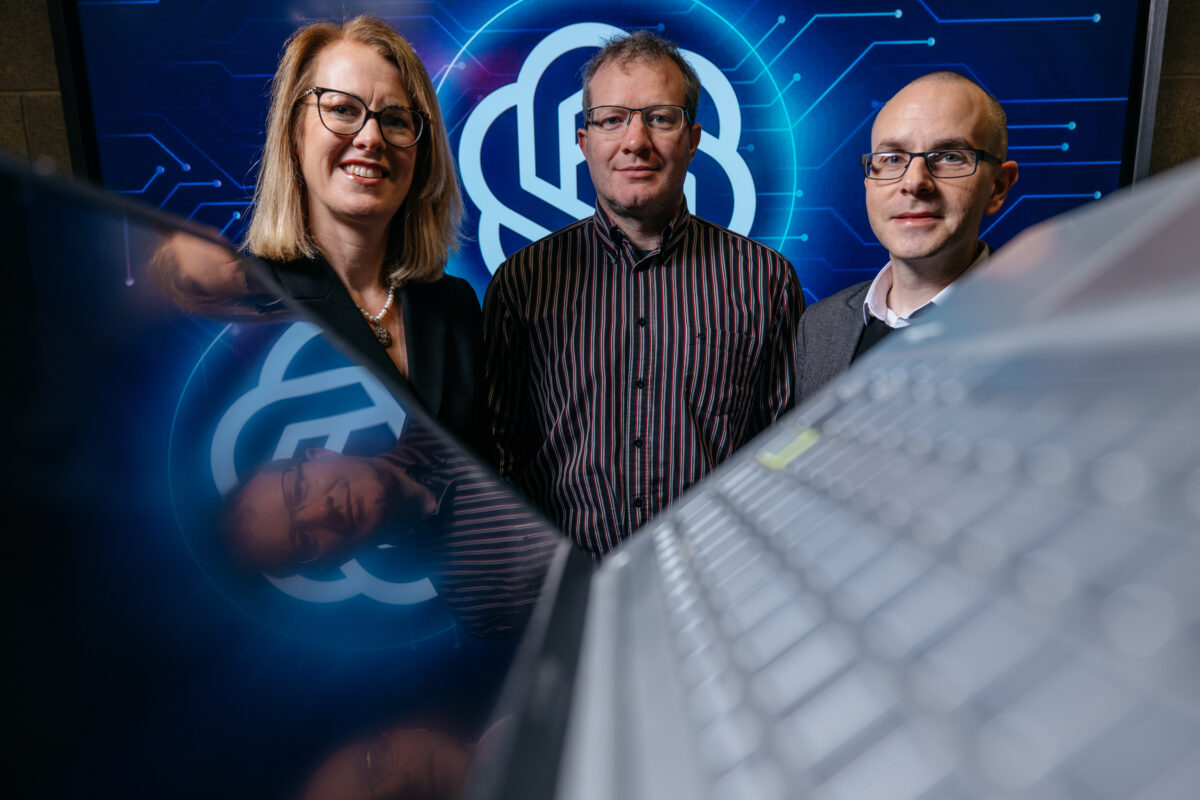

As a lecturer in Information Management at University of Limerick, investigating the impact of AI on work and society has always been an integral part of Dr Patrick Buckley’s research agenda.

Joined by his Kemmy Business School colleagues Professor Elaine Doyle, Professor of Taxation and Dr Brendan McCarthy, Patirck’s research has sought to gain a more nuanced understanding of the impact of AI on the role of the tax practitioner.

“One of the challenges of this work is that AI will impact different professions and sectors of the economy in different ways, depending on what the capabilities of the AI systems are at a particular point in time and on the distinctive features of a profession,” explains Dr Buckley.

“We considered that to really start making realistic forecasts about the impact of AI on work that can inform and guide practice, our analysis needed to focus on specific professions in a robust manner.

“That’s where the academic rigor but also the practical experience of Elaine and Brendan, both of whom have worked as tax practitioners, were essential in terms of understanding what a tax practitioner does at various stages of their career.

“Recognising that there is a gap whereby impactful research needs a multi-disciplinary approach that combines expertise in AI with an informed knowledge of real-world practice in a discipline, in this case tax, is what prompted us to start this work. It’s also fun to work as a team and holding each other to account makes it more likely that we achieve deadlines,” adds Dr Buckley.

There is general acceptance that AI automation will have a significant impact on tax practice.

“Our analysis supports this, with several of the tasks traditionally associated with tax practice seen as being highly susceptible to automation,” explains Professor Doyle.

Their research forecasts that some tasks are very likely to be automated while others remain unlikely, at least for the foreseeable future. This suggests that the tax practitioner role won’t disappear, but it will need to evolve.

The tasks performed by early career practitioners are those most vulnerable to AI automation and significantly fewer individuals are likely to be needed at the tax trainee level. How then will tax practitioners replenish their more senior ranks if the bottom rungs of the career progression ladder are populated by significantly fewer trainees?

“In an extreme case, firms may face severe skills shortages years after engaging in significant automation,” stated Professor Doyle.

Reflecting on her time working in industry, Professor Doyle said: “I joined PwC (then PriceWaterhouse) as a tax trainee in an era when there was one desktop computer in an office shared by two people – it was located in the corner of the room and accessed only occasionally. All client files were paper based, and communication was through the post (yes, I am that old!).

“By the time Brendan started practicing in tax the roll-out of the Revenue Online Service (ROS), as well as the development of tax software packages in later years, had largely replaced the manual completion of tax returns.

“The type of tax compliance work we would both have engaged in during our first few years is all fully automated now and tax trainees today are engaged in work involving professional judgement skills at a much earlier stage.”

AI and automation have lessened the amount of time consuming ‘drudge’ work that needs to be undertaken and frees up time to engage with clients on higher value work such as planning and professional advice rather than routine calculations, however Professor Doyle notes this makes the work more interesting albeit challenging.

“I really understood all the nuts and bolts of tax computations because I had to do them manually. Not having that in-depth technical knowledge may impact on the degree to which tax practitioners can give robust professional advice. For example, you may be less competent to advise a client on how to maximise the tax-free element of a termination payment if you don’t know how the tax-free element is calculated.”

A key area of their research considered the impact on the desirability of pursuing a career in tax.

“AI will reduce the time spent on routine tax compliance tasks which will mean fewer tax trainees will be needed. If fewer tax trainees are recruited into firms, the pipeline of employees who will progress to more senior levels will also be reduced,” says Professor Doyle.

What next then for students considering a career in tax?

“Tax practice is changing significantly in terms of the use of technology, but we haven’t seen a slowdown in the levels of recruitment happening for tax trainees yet,” observes Professor Doyle.

“I think students who possess the right balance of skills will still do well in a tax career, but they will have to be more tech savvy and be able to add value to a client beyond tax compliance work. As a profession, tax will need to evolve so that practitioners can advise on a wide range of business issues including sustainability.

“Tax practitioners will therefore need to be able to shape and guide the decisions and recommendations these AI systems will make, without having specific detailed knowledge of how particular judgements or decisions are made by an AI system. That’s going to be a big change for a profession that has always prided itself on precision and detailed technical understanding.”

Along with tax trainees, educational institutions will also have to adapt for the future.

Universities will need to include data analytics and sustainability content in all their tax offerings to appropriately prepare tax students for their role as future professionals. Being able to communicate with clients effectively and present complex information in an accessible manner will also be important skills that need to be developed and enhanced in students. These skills are most appropriately developed using experiential and active learning techniques and are more easily developed in small classes.

As such, educators will need to innovate in order to overcome the challenge of large class sizes, explains Professor Doyle.

There are several potential research opportunities arising from this research, co-author Dr Brendan McCarthy notes.

“The methodological approach we developed for this study could be applied to provide a more nuanced analysis of the challenges faced by other disciplines that are perceived to be under threat from the advent of AI.

“We are also exploring research ideas aimed at deepening our understanding of the challenges the tax domain faces in the coming years and how the profession will need to evolve to meet those challenges,” Dr McCarthy adds.

Published by UL Links Future Focus edition